What are margins?

Our role as Britain’s energy system operator is to manage the flow of electricity around the grid so it’s available when people need it – and that means keeping the supply secure.

Supply and demand must be matched in real-time. It’s what we call ‘balancing’ the system, and it’s all managed by our national control room.

Our control room is a bit like air traffic control for electricity – we keep megawatts moving safely from one part of the country to another on Britain’s high-voltage pylons and cables.

And like any important system that people rely on, we build in safety buffers in case things don’t go as planned.

This is our operating margin and we’re required to hold it by the energy regulator, Ofgem.

It’s the cushion of spare capacity on the electricity system.

To operate the system securely we need a combination of power sources. There’s generation scheduled to run so we can balance supply and demand and then power sources which we’re keeping in reserve to deal with sudden changes, for example if a generator goes offline or a lightning strike damages transmission infrastructure. One way of remembering this is “demand to meet; reserve to keep”.

When we talk about margins, we normally mean the available cushion over and above this combined power source capacity. We call it upward margin, and it’s more of a focus over the winter months when demand is higher.

But our safety margin can also mean the flexibility for power sources to reduce output to avoid having too much power on the system. We call this downward margin, and it’s something we managed during summer 2020 when we saw record low levels of electricity demand.

If a power source tripped and we didn’t have any electricity in reserve, we wouldn’t be able to cover the loss, and the system would be tipped out of balance. This would impact the system’s frequency, and put the country’s supply at risk.

So we always make sure there’s a healthy safety buffer, and that our margin is never reduced to the point where we don’t have enough reserve to respond to an unexpected event.

Likewise, if demand is unusually low and there’s too much power on the system, we need to have some downward margin to be able to reduce power sources' output in a safe way to avoid the frequency becoming unstable.

It’s normally a combination of factors, and rarely one issue in particular.

Common contributing factors include the weather – including temperatures and wind speeds – demand levels and the availability of power sources over periods of the day with higher demand.

The level of electricity imports and exports over Britain’s interconnectors with neighbouring countries can also play a role.

It’s not uncommon for power sources to be on outage at different times of year, either for planned maintenance or because of an unexpected issue.

NESO doesn't own or operate any power sources. We take power that has been generated and move it around the county to balance supply and demand.

We’re in constant communication with generators and transmission owners to make sure outage schedules don’t impact the operation of the system.

Wind speed and generation levels are not the sole cause of tight margins – there are normally a range of factors involved.

While we expect zero carbon sources like wind to dominate electricity supplies in the future, we also expect to have a diverse generation mix – including wind, solar, storage, nuclear and interconnectors.

That means, like today, we’ll never be reliant on one power source to keep our margins intact and continue securely supplying electricity.

No. Even if we issue a system notice signalling tight margins, it doesn’t mean the electricity supply is at risk – it’s just a routine way for us to tell the market we want our cushion of spare capacity increased.

Our control room has considerable experience dealing with reduced operating margins, and has the tools and expertise to manage it.

Over winter, our analysts are always looking ahead to the next “darkness peak” – the point of highest demand in the evening.

They’re forecasting how much electricity generation will be needed to balance the system and keep our reserve intact.

If the cushion above those requirements is reduced, we might consider issuing a notice to the electricity market to ask for it to be restored. This doesn’t mean electricity supply is at risk.

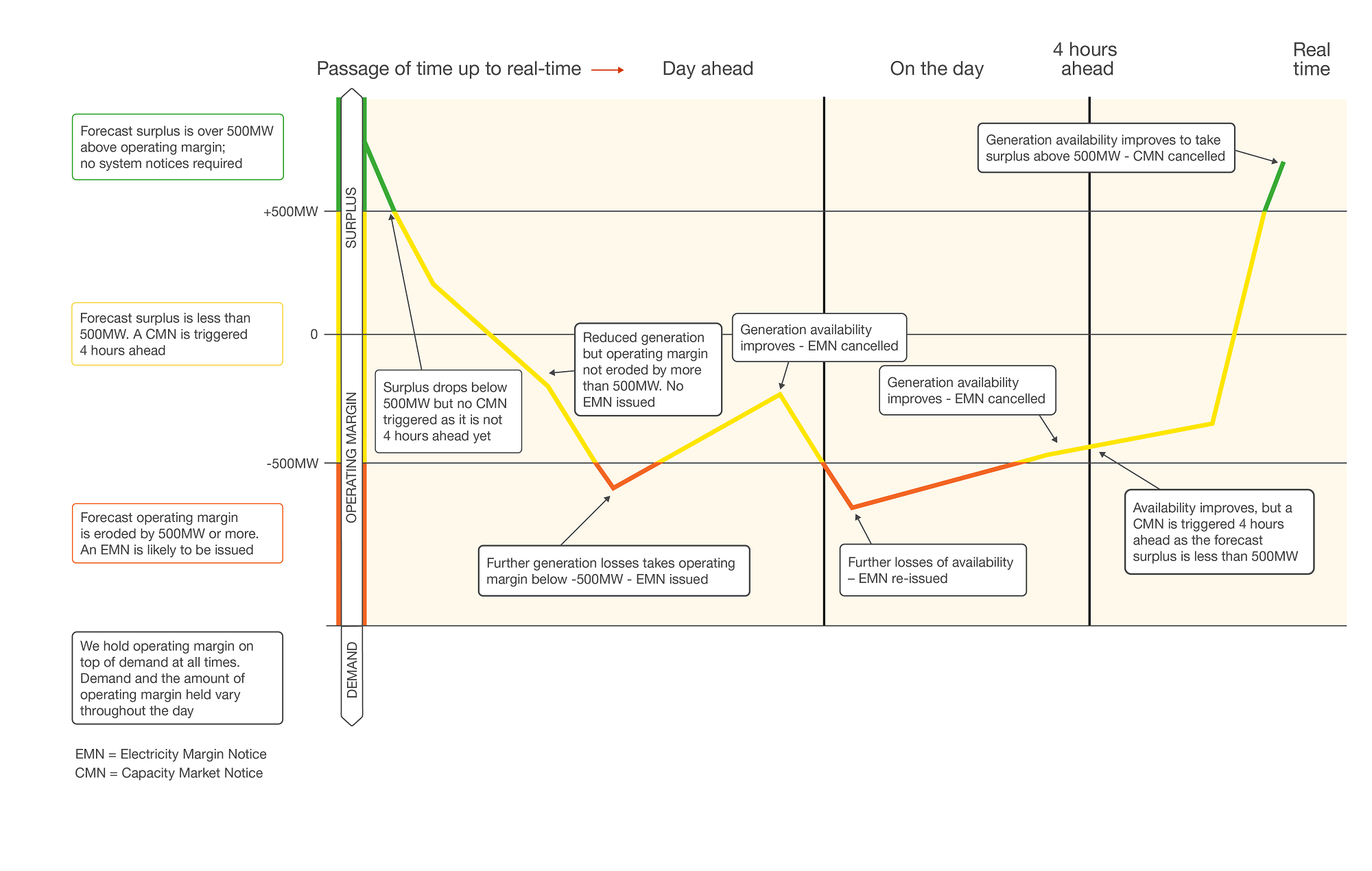

The graphic below is for illustrative purposes only to show when – and why – an notice (EMN and CMN) might be issued during the 24 hours up to real-time, and is not based on real data. The coloured line indicates the forecast buffer of surplus capacity above demand and the operating margin that we’re required to hold to operate the system at real-time.

Click here to enlarge the graphic

As we get closer to darkness peak, our forecasts become more certain in terms of predicted demand for electricity, weather and what power sources are available.

That means the level of reserve we’re required to keep reduces to more accurately reflect the current conditions – which in turn can relieve any pressure on operating margins.

The diversity of Britain’s electricity mix is one of the reasons we have one of the most reliable electricity systems in the world.

It means we have a range of power sources that can make themselves available and offer extra power – though some can respond more flexibly than others.

In all cases, market dynamics help to encourage a response from electricity providers. If demand goes up, prices follow suit, and power sources are more likely to start generating electricity to offer for sale on the electricity market.

Pumped storage can provide a fast, powerful injection of megawatts into the grid (particularly useful for demand ‘pick ups’), though only for relatively short periods.

Importing power from our neighbouring countries over interconnectors is a more common response to tight margins – with the market dynamics described above meaning electricity flows towards the higher prices.

And although we’re moving away from using fossil fuel power sources, today gas plants – and to a lesser degree coal – still play a role in helping us manage margins.

Another type of response comes in the form of the capacity market.

The capacity market is one of the ways we’ve worked with government to make sure there’s enough electricity available – and that power sources will deliver it when needed.

It’s been in place over winter since 2017, and acts a bit like an insurance policy against electricity supplies running too low. In return for regular payments, power sources in the capacity market must provide electricity if the system needs it, or face penalties.

Think of it like a group of back-up sources we have at our disposal ready to respond to help balance the system in times of stress.

No. Since the end of the transition period, the flow of electricity over interconnectors has continued uninterrupted to and from EU countries, and we don’t anticipate any future arrangement changing that.

Not harder, but more complex.

As more renewables enter the mix, electricity generation patterns become more weather dependent and harder to forecast – factors which can lead to significant variability in the scale and location of electricity supply.

This all has an impact on how we balance the grid and maintain our operating margin.

But we’re equal to the challenge. Our control room experts have the tools and capabilities – and are developing new ones – to manage the complexities.

And our forecasting teams do a fantastic job 24/7, working with weather forecasters and modellers to accurately predict demand, supply and all the other complex variables involved in balancing Britain’s network.